MSU Research Foundation and Broad College of Business Announce 2024 Student Venture Capital Fund Investment in Startups

From protein-packed ice cream to advanced factory inspection technology, Michigan State University's Student Venture Capital Fund showcases five startups for pre-seed investment, highlighting student-led entrepreneurship and investing.

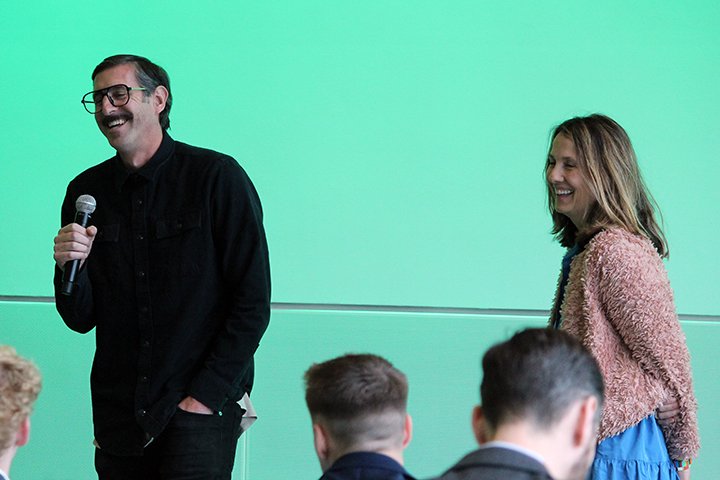

EAST LANSING, MI — The Michigan State University Research Foundation and Broad College of Business Center for Venture Capital, Private Equity and Entrepreneurial Finance have announced recommendations for pre-seed investment in five promising Michigan-based startups at the sixth annual Student Venture Capital Fund (SVCF) Investment Celebration event held on April 2 in East Lansing. The SVCF provides hands-on experience in venture capital investing for students taking the FI 444: Entrepreneurial Finance course at MSU. In the class, students review a pipeline of early-stage startup companies from the entrepreneurial ecosystem and conduct investment selection, due diligence, market and competitive analysis, and valuation analysis to make an investment recommendation to Red Cedar Ventures, a venture capital subsidiary of the MSU Research Foundation.

The five companies chosen this year are:

Protein Pints, a high-protein, premium ice-cream product that provides 45 grams of whey protein isolate with low sugar content, developed by student entrepreneurs.

LaparAssist, Inc., developer of medical technologies that help healthcare providers deliver optimal, precise, and time-efficient care to their patients.

MotMot, providing cost-effective inspection services for drinking water infrastructure, using proprietary Autonomous Underwater Robotics (AURs) and sensor technology, aiming to enhance water security for communities.

Deepview, reinventing smart cameras for factory visual inspections, using deep learning technology to inspect factory parts with superior accuracy compared to human inspection workers.

ArtClvb, a platform that connects artists, collectors, and galleries, facilitating the display, purchase, and sale of art while fostering profit-sharing for artists and global relationships within the art community.

“This initiative equips students with hands-on venture capital experience and nurtures future investors and entrepreneurs,” said Hayong Yun, Associate Professor and Co-Director of the Center for Venture Capital, Private Equity and Entrepreneurial Finance at MSU. “Seeing our students actively engage in evaluating and funding startups, supported by the MSU Research Foundation, showcases experiential learning's impact. We're grateful for the partnership in this visionary project.”

The SVCF program has provided more than $250,000 of pre-seed and seed stage investments deployed in 27 companies. Those companies have gone on to raise over $64 million from dilutive and non-dilutive sources.

"Classroom learning through reading and lectures is valuable, but nothing compares to the practical experience of real-world due diligence," emphasized Jeff Wesley, Executive Director of Ventures at the MSU Research Foundation. "Students gain a deep understanding that goes beyond textbooks when they make investment decisions based on intangible factors. They quickly learn how much influence the founding team has on making investment decisions."

The current SVCF portfolio is a diverse set of investments covering many sectors. Most of the companies in the portfolio have experienced success this past year, many of them attracting new angel and venture capital investments in addition to winning grants for non-dilutive sources available from the State of Michigan and federal government programs.

“Having the students think through priced investment rounds, debt conversions, bridge financings and standard venture metrics in a real portfolio will make them more attractive candidates upon graduation,” Wesley added. “We believe this partnership will help solidify the Broad College at Michigan State as a producer of emerging talent for the venture industry.”

The SVCF also has an outstanding team with many different majors and minors represented. The class includes finance, management, supply chain, engineering, computer science, neuroscience and biology majors, plus students in the entrepreneurship minor.

"Our collaboration with the MSU Research Foundation brings valuable hands-on experience to Broad undergraduates interested in venture capital investing," continued Yun. "And it contributes to the broader innovation environment by building a portfolio of early-stage startup companies originating from within our MSU community."

The SVCF Investment Celebration event attracted more than 100 participants, including many MSU alumni in the venture industry, advisory board members, and guests.